HOA taxes made simple for everyone.

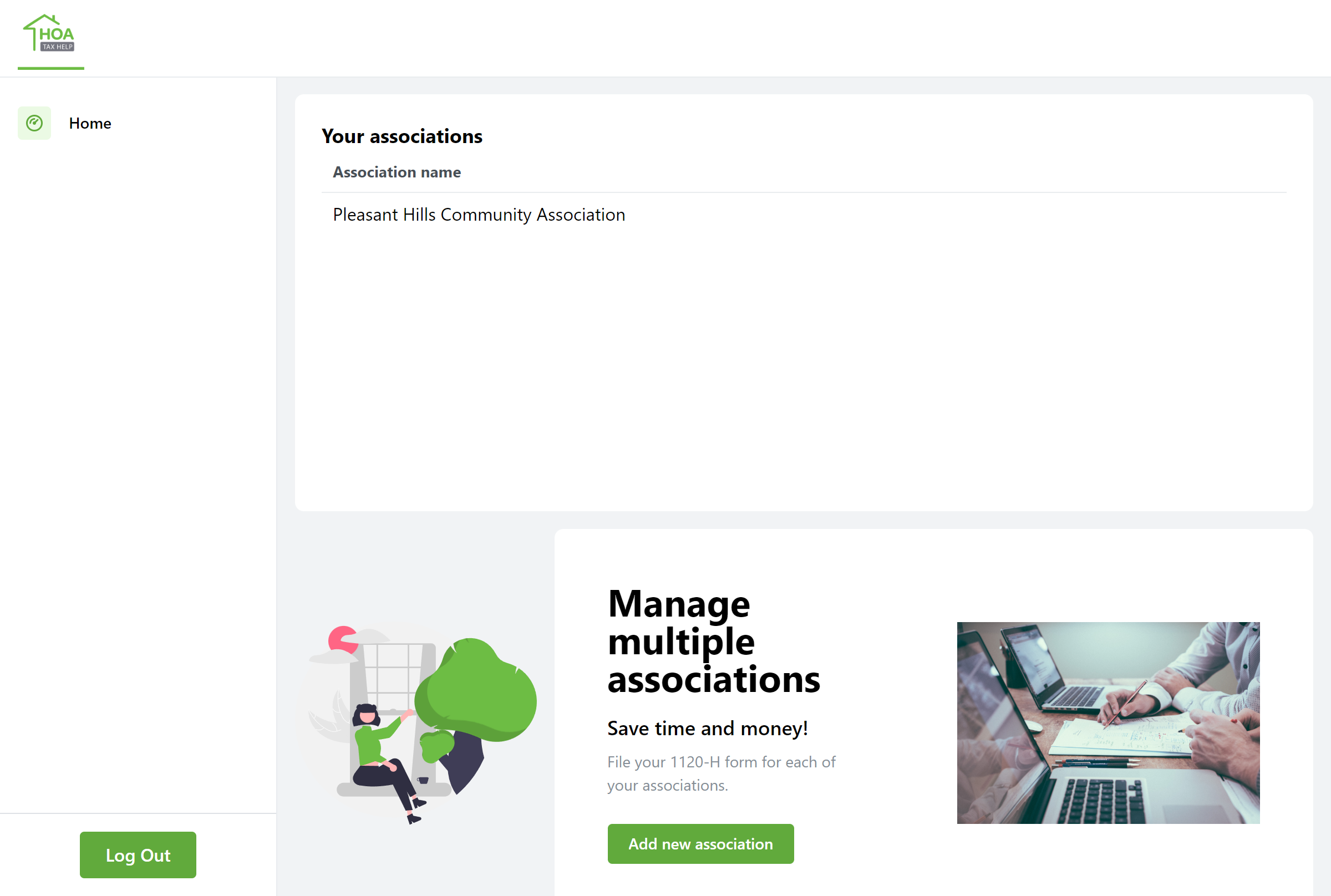

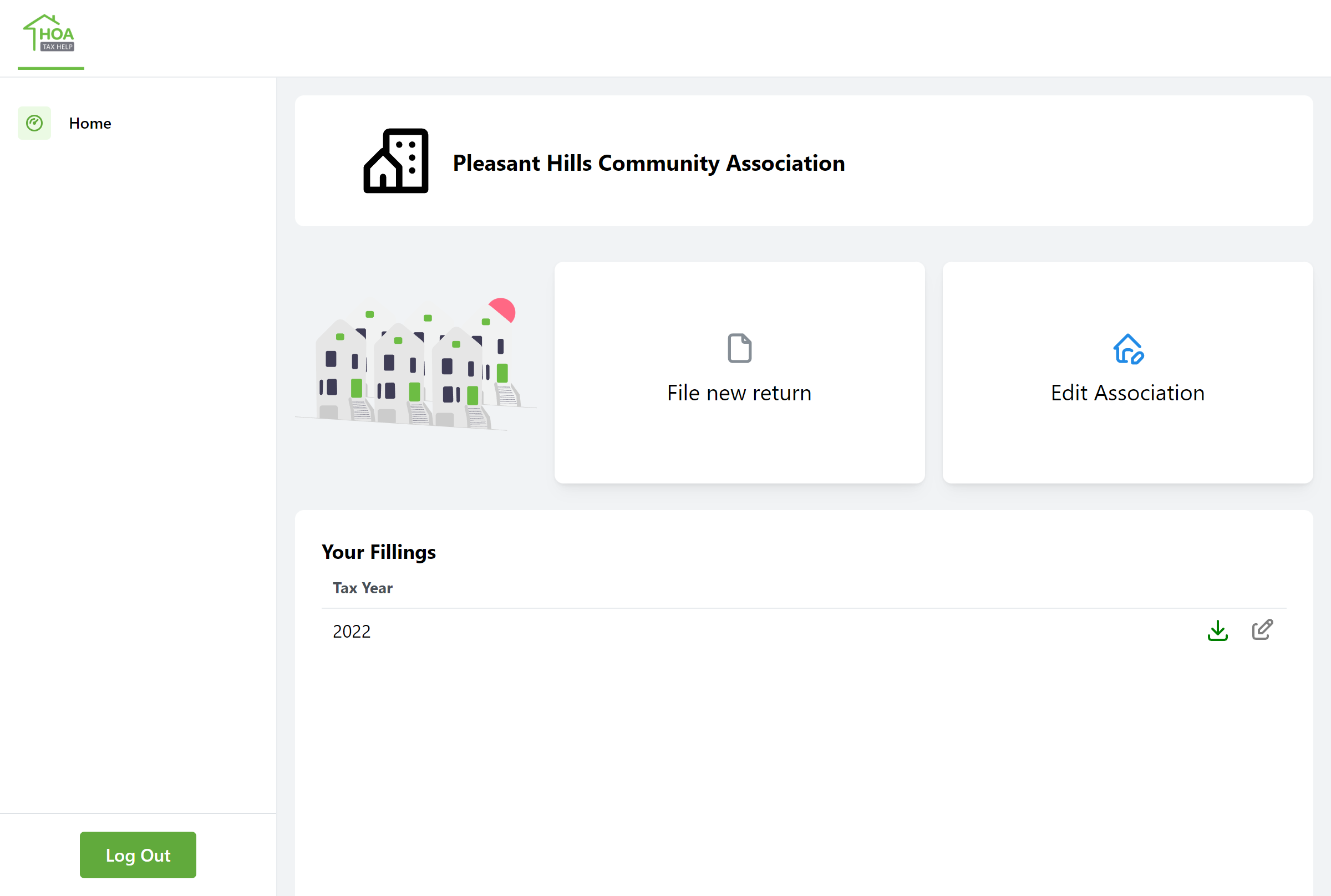

HOA Tax Help will let you complete the IRS tax return form 1120-H for a condominium or a homeowners association in just a few steps.

Everything you need to file your 1120-H form.

Complete 1120-H Form Filing Assistance: From Preparation to Submission

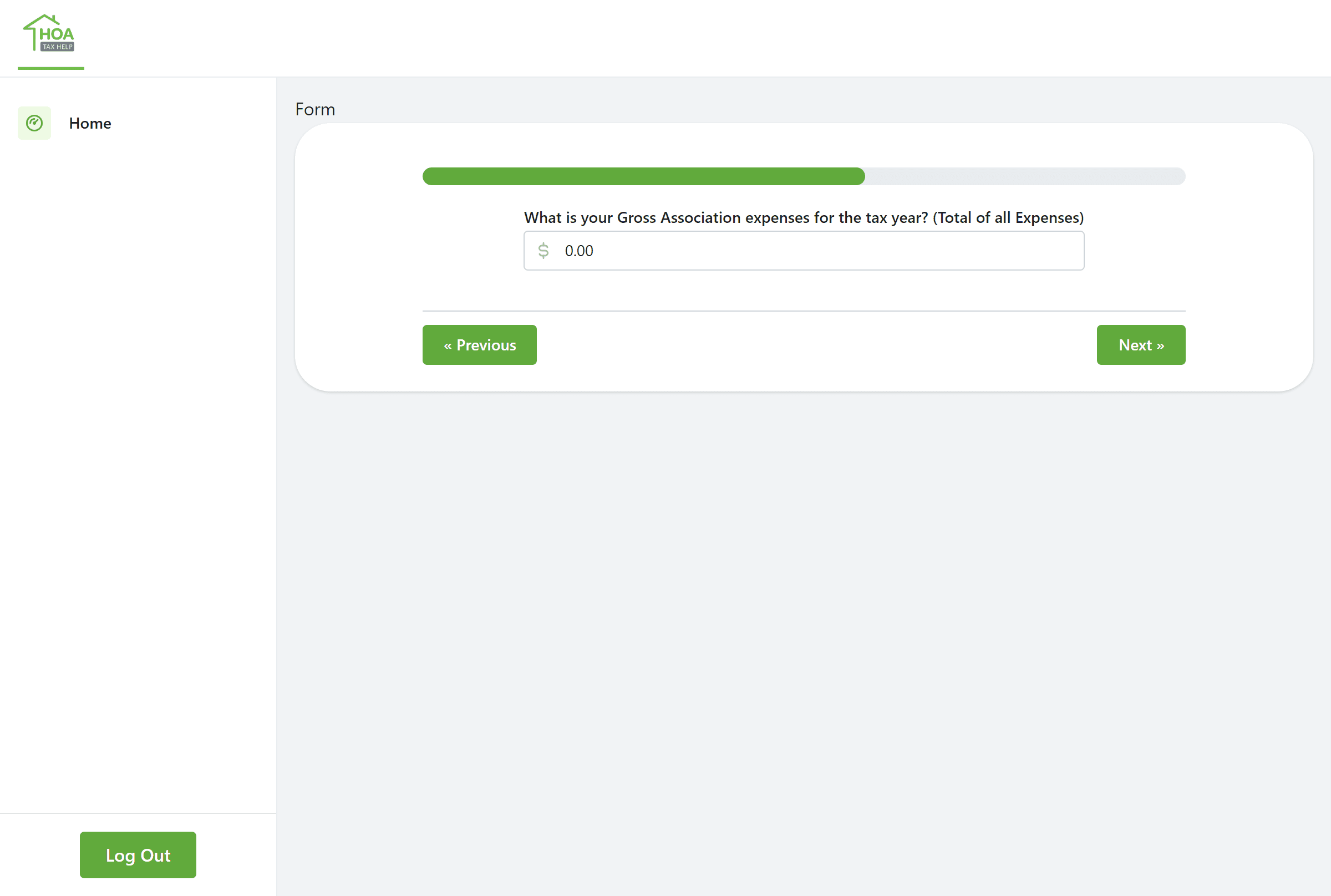

Step by step tool to generate your 1120-H form.

Simple pricing, for everyone.

Transparent pricing for 1120-H tax form preparation

| Feature | Included |

|---|---|

| Filling options | Yes |

| Deadline reminders | Yes |

| Save information | Yes |

| Taxable income calculation | Yes |

| Feature | Included |

|---|---|

| Phone support | Yes |

| Association specific guidance | Yes |

| 1120-H form specific questions | Yes |

| Feature byProducts | HOA Tax Help | TaxAct | TurboTax |

|---|---|---|---|

| Pricing | $124.95 | $170 | |

| Features | |||

| Filling options | Included in HOA Tax Help | Included in TaxAct | Included in TurboTax |

| Deadline reminders | Included in HOA Tax Help | Included in TaxAct | Included in TurboTax |

| Save information | Included in HOA Tax Help | Included in TaxAct | Included in TurboTax |

| Taxable income calculation | Included in HOA Tax Help | Not included in TaxAct | Not included in TurboTax |

| Support | |||

| Phone support | Included in HOA Tax Help | Included in TaxAct | Included in TurboTax |

| Association specific guidance | Included in HOA Tax Help | Not included in TaxAct | Not included in TurboTax |

| 1120-H form specific questions | Included in HOA Tax Help | Not included in TaxAct | Not included in TurboTax |

| Choose your plan | |||

Get started today

Complete your 1120-H form for your association or condominum in just a few steps

Start FilingFrequently asked questions

If you can’t find what you’re looking for, email our support team.

What types of taxes does HOA Tax Help assist with?

HOA Tax Help specializes in completing the 1120-H Form

Do I need prior knowledge of tax laws to use HOA Tax Help?

No prior knowledge of tax laws is required. HOA Tax Help's user-friendly website guides you through the process.

Is my personal and financial information safe on HOA Tax Help's website?

Your personal and financial information is protected by industry-standard security measures on HOA Tax Help's website.

Can I e-file my tax returns through HOA Tax Help?

No. The IRS does not allow e-file for the 1120-H form. You must print the completed return and mail it with the included mailing instructions.

How do I ensure the accuracy of the information I provide?

HOA Tax Help's website includes built-in error checking features to ensure the accuracy of the information you provide.

Does HOA Tax Help provide support during the tax preparation process?

Yes, HOA Tax Help provides customer support to assist you with any questions or issues during the tax preparation process.

How long does it take to complete my tax forms using HOA Tax Help?

The time it takes to complete your tax forms using HOA Tax Help varies based on the complexity of your tax situation and how quickly you provide the required information. However, HOA Tax Help's user-friendly website and efficient processes aim to make the process as fast and convenient as possible for you.

Does HOA Tax Help support multiple states for tax preparation?

Not as this time, only the federal 1120H is available